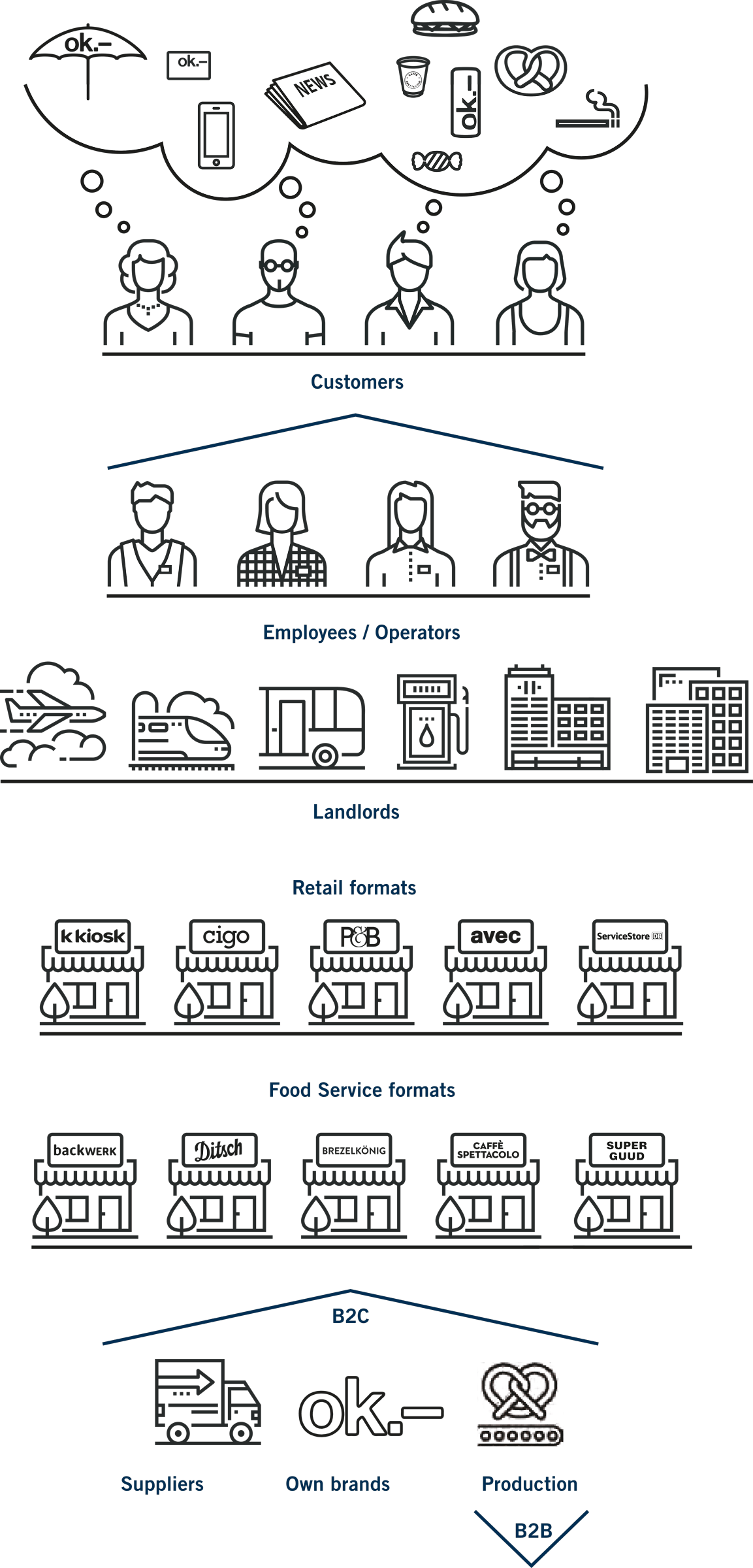

We brighten up our customers’ day. Wherever people are on the move.

We offer the best food and convenience concepts based on: an in-depth understanding of customers and formats, operational excellence, ongoing innovation and agility as well as optimal value creation.

Valora Brands

Formats

avec — Modern convenience format at highly frequented locations, for example train stations or service stations, with an extensive offering of fresh food, other comestibles and regional products.

BackWerk — Germany’s largest self-service bakery with a broad and flexible range of snacks and feel-good food.

Brezelkönig — Sale of high-end lye bread products, such as pretzels, baguettes, croissants, hot dogs or selected sandwich snacks when on the move. International franchise system.

Caffè Spettacolo — Italian-themed coffee bar concept with its own locations and an integrated coffee module concept for other Valora formats.

cigo — Tobacco retailer also offering press products and a range of services for people on the move.

Ditsch — Leading producer and provider of pretzels and products for immediate consumption for the retail and wholesale market with its own branch network.

k kiosk — Market leader in the kiosk business, mainly supplying tobacco, press and lottery products. A growing share of food as well as fresh products and expanding digital services offering.

Press & Books — Specialist in delivering a wealth of reading. Extensive press offering complemented by selected book titles and a range of services for people on the move.

ServiceStore DB / U-Store — Convenience format in Deutsche Bahn or Hamburger Hochbahn locations for commuters’ everyday needs.

SuperGuud — Small, trendsetting snacking concept. The Valora format with a difference for the adventurous, urban commuter.

Own Brands

bob Finance — the bank-independent financial services provider offers practical financial services tailored to modern and digital requirements at fair conditions.

ok.– — the own brand with the best price/performance ratio is the trendsetting companion of young, mobile people and synonymous with a dynamic, urban lifestyle.

Foodvenience

Convenience as the shopping experience and as a product range combined with an ever growing fresh food selection – that is foodvenience at Valora.

[ Food + Convenience ]

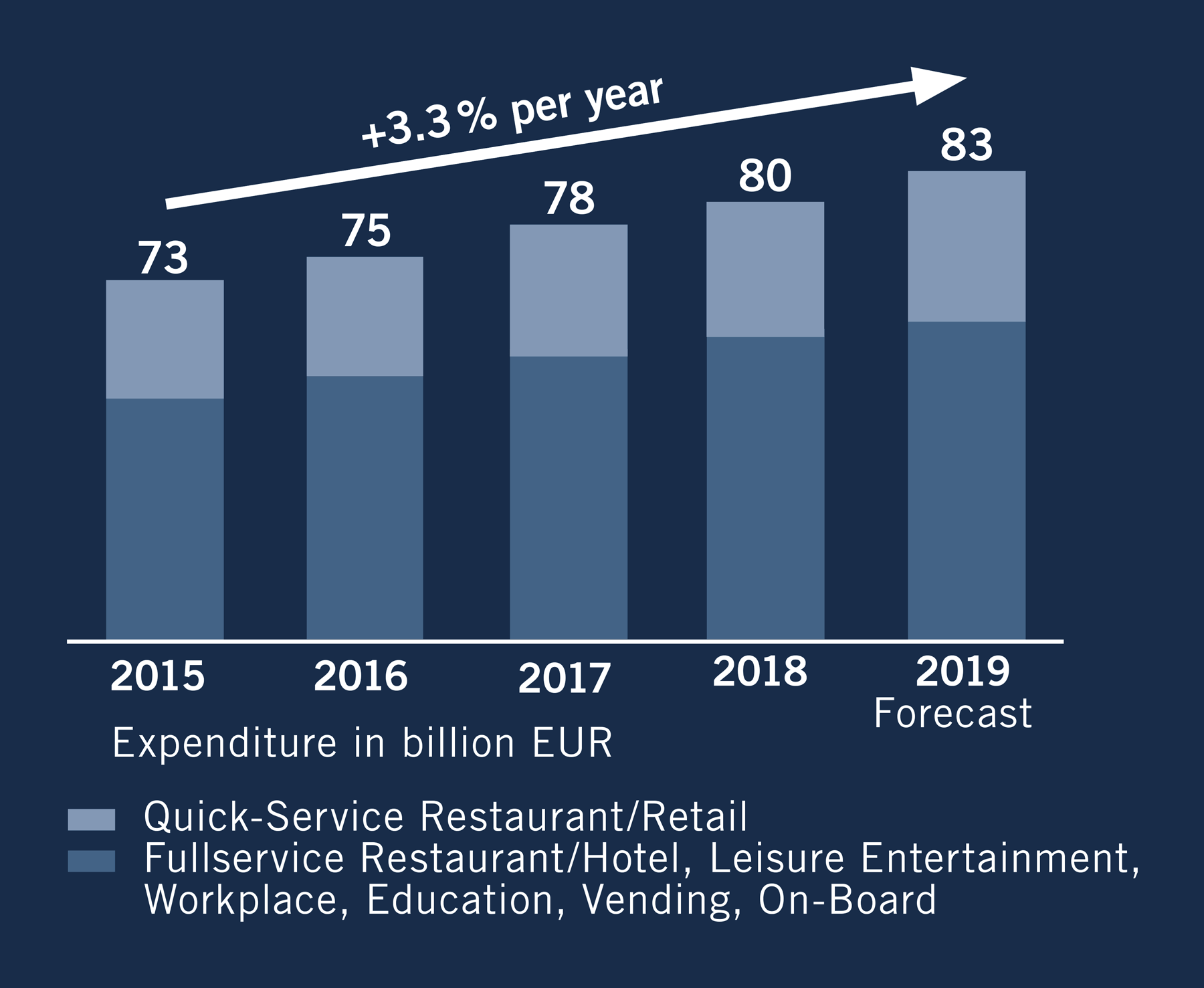

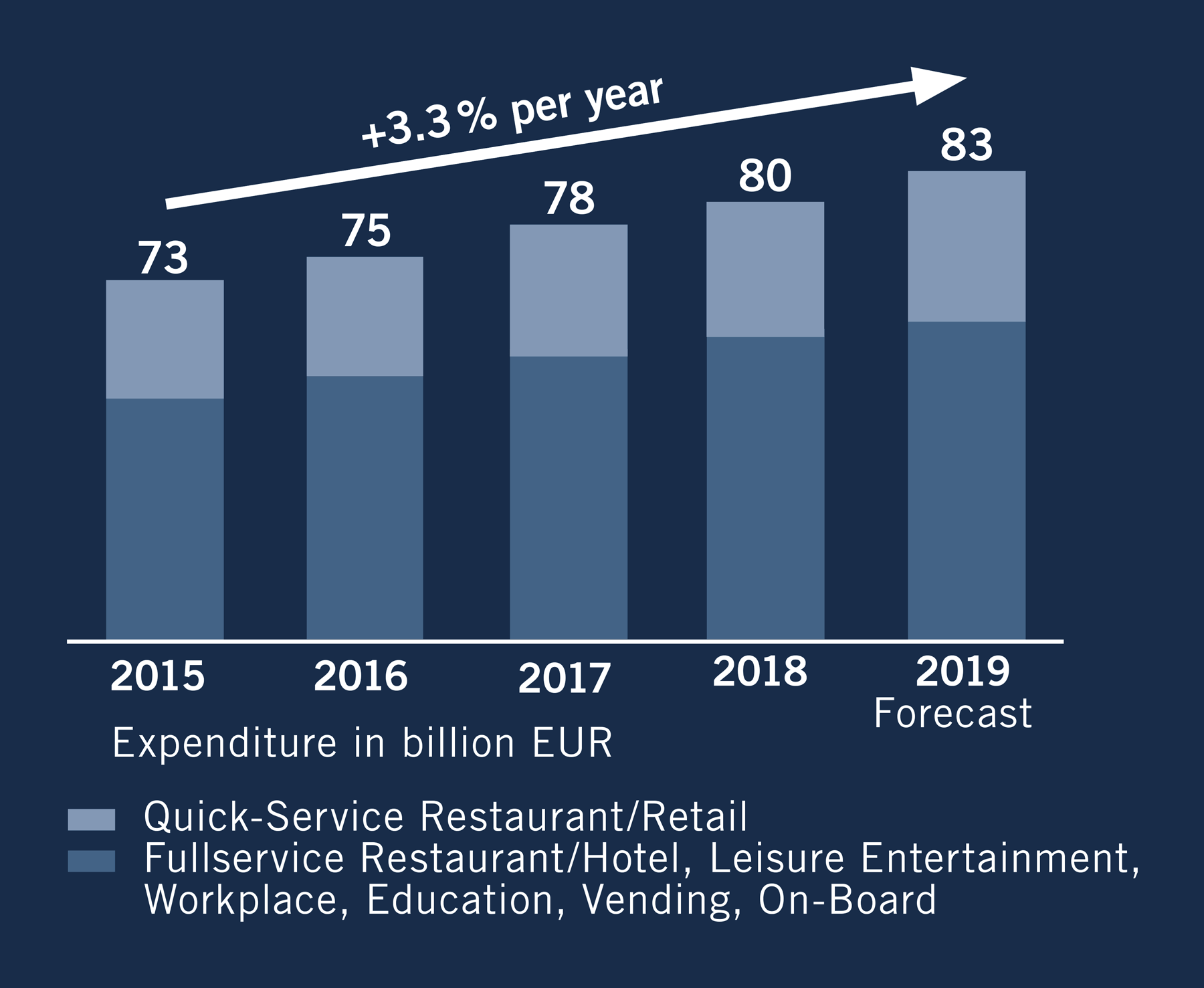

Positive market environment

Recent development shows that consumers are demanding foodvenience. Convenience sales in 2018 reached a market volume of EUR 4.5 billion in Switzerland and EUR 13.2 billion in Germany. The markets grew on average by +3.7 % and +1.6 % per year respectively between 2013 and 2018.* This trend corresponds to Valora Group‘s annual growth of +3.5 % in the foodvenience categories food, non-food (excluding press, books, tobacco) and services. The food category performed at +3 % per year (excluding the BackWerk acquisition in 2017) and it accounted for the biggest share (83 %) of foodvenience external sales in 2019.

Besides highly frequented locations in the inner city and agglomerations, shopping centres and service stations, transport hubs are particularly ideal foodvenience locations. More than half a million customers visit Valora‘s sales outlets at these locations daily and they account for approximately half of Valora’s external sales.

As a result, a growing number of supermarket operators and other providers are targeting these sites. However, Valora‘s success in its core business stems from its competence and experience, which date back to its first kiosks at SBB stations over 100 years ago.

* Source: AlixPartners, 2019

Trends

Three social macrotrends determine what Valora customers need: Mobility, the changing lifestyles and rapid growth of digitalisation in everyday life. As a clearly positioned foodvenience provider, Valora systematically aligns its business and offering with these trends and their resulting customer needs. Valora is where its customers want it to be, providing them with what they want whenever they want it.

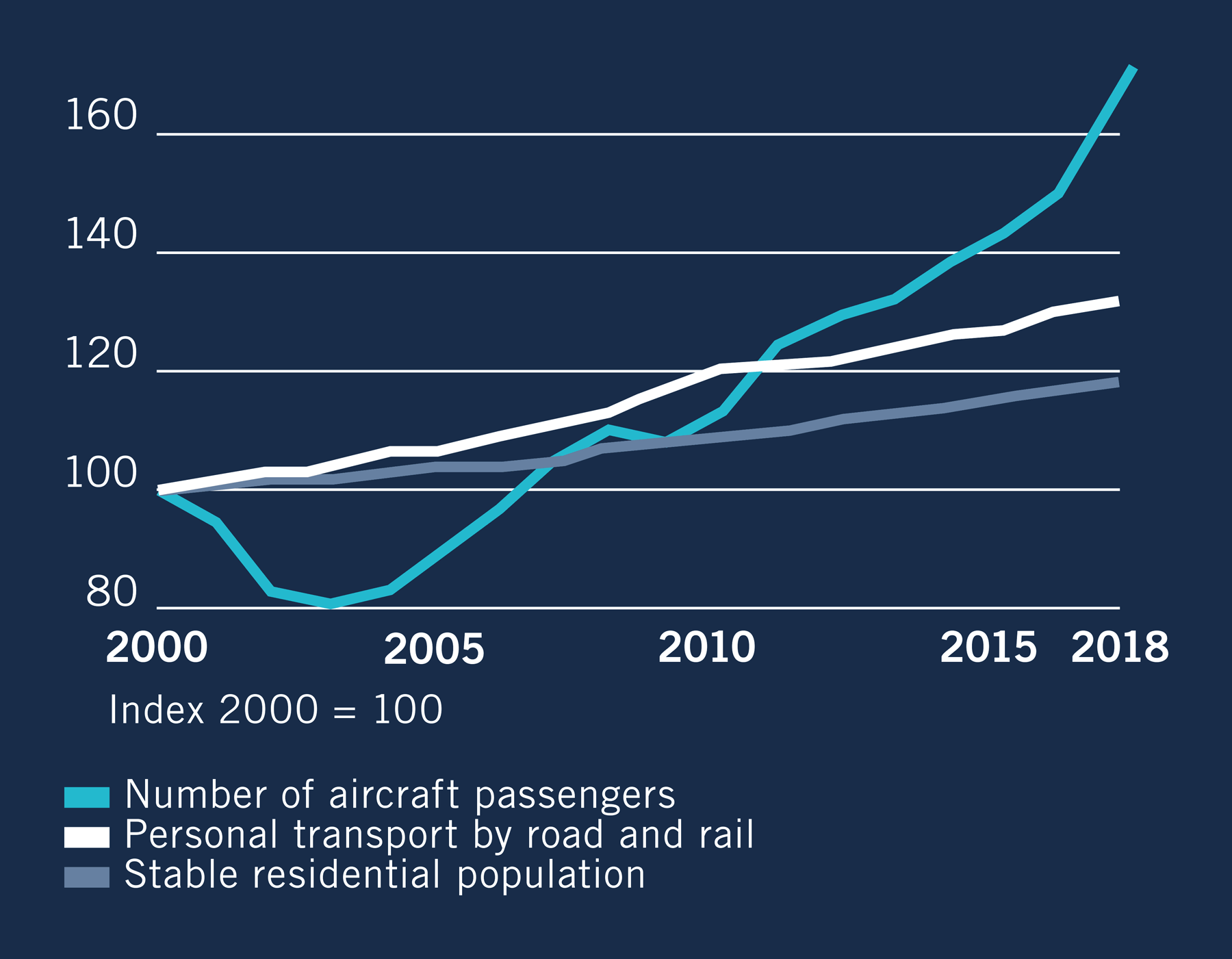

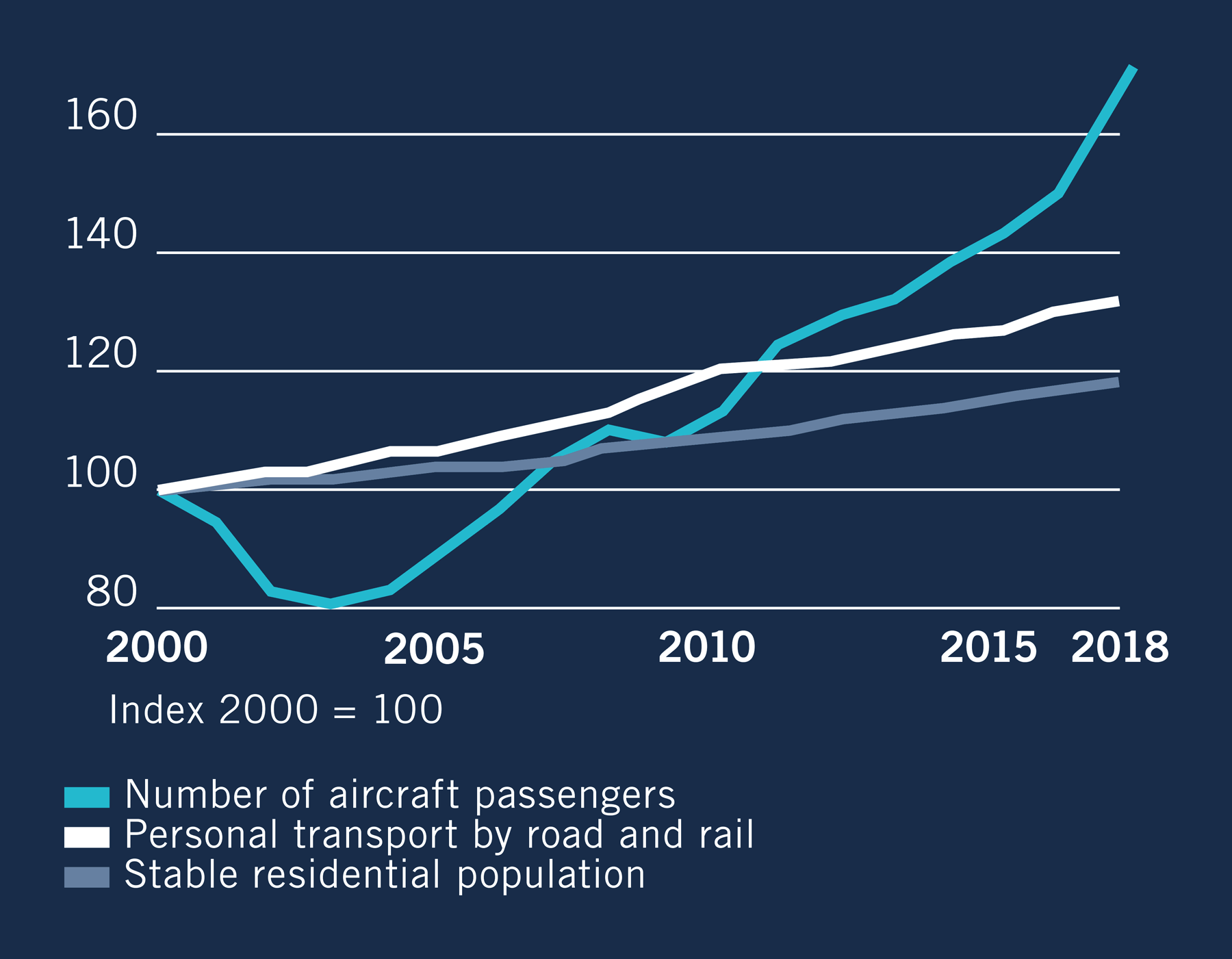

Mobility

Society is becoming ever more mobile. People are permanently on the move – by road, rail or air. The boundary between private life and work, city and countryside is becoming blurred. However, daily needs are constant and must be met, even when on the move.

Lifestyle

Lifestyles have shifted. A growing number of people live in smaller households or alone. People are more flexible with their daily routine and are more likely to eat outside the home, at different times of day, quickly consuming smaller meals or snacks.

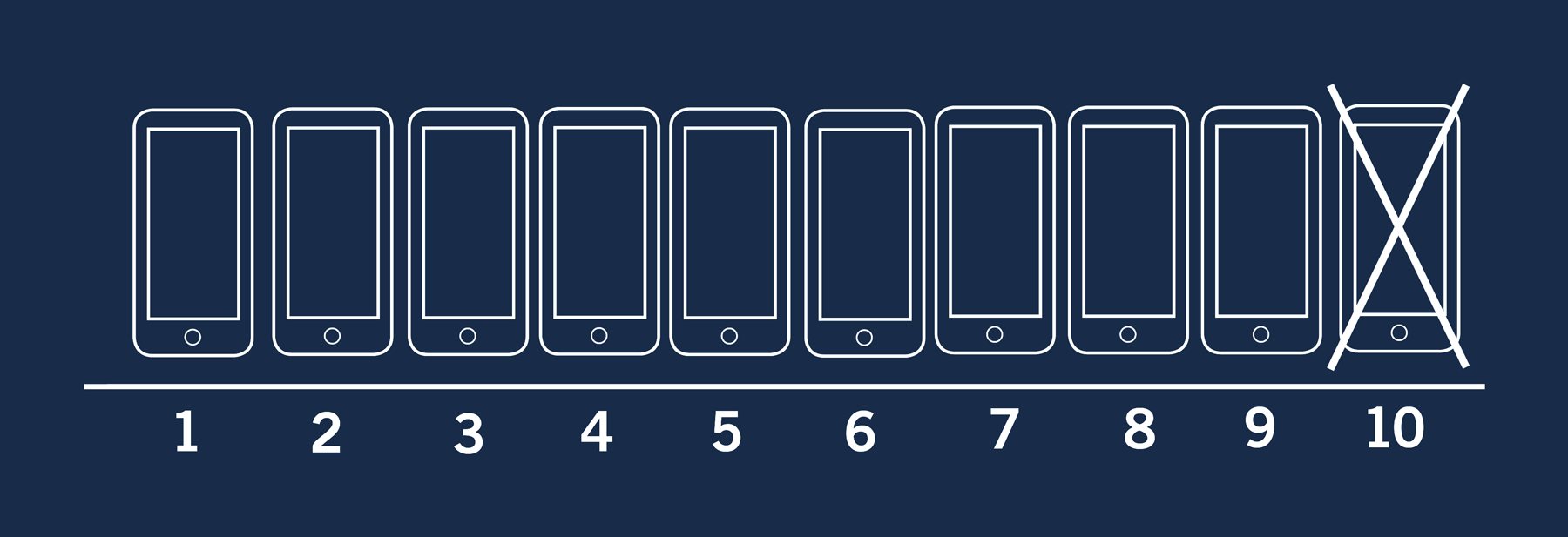

Digitalisation

Meanwhile digitalisation has touched all areas of life. People are always connected through their smartphones wherever they may be. The opportunities presented by new technologies fundamentally redefine the customer relationship and shopping experience by opening up new options.

1) Federal Statistical Office, 2019

2) npdgroup Germany, 2019

3) Deloitte, Global Mobile Consumer Survey, 2018

Strategy

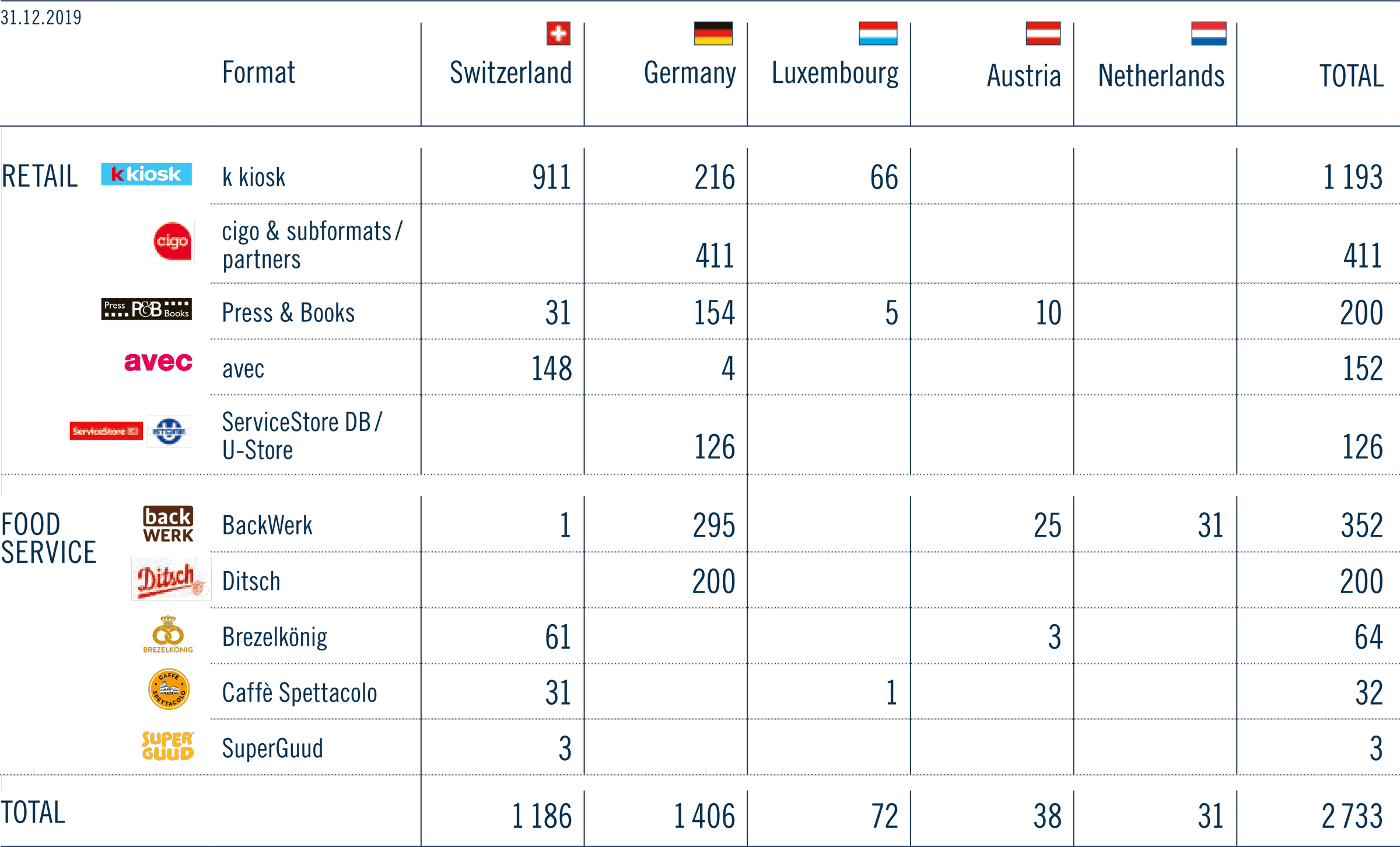

Each and every day, around 15 000 employees in the Valora network work to brighten up their customers’ journey with a comprehensive foodvenience offering – nearby, quick, convenient and fresh. Valora applies a multiformat strategy with eleven sales formats and more than 2 700 outlets at highly frequented locations in Switzerland, Germany, Austria, Luxembourg and the Netherlands. The company recruits committed entrepreneurs to manage its outlets, builds on strong own brands and benefits from a vertically integrated value chain as one of the world’s leading pretzel producers.

Five strategic pillars

Valora has communicated its strategy until 2025 for the entire Group and its Retail and Food Service divisions in order to move closer to its vision of having the best food and convenience concepts. The strategy is based on five strategic pillars:

Growth,

Efficiency,

Innovation,

Performance-

oriented Culture,

Sustainability.

Growth

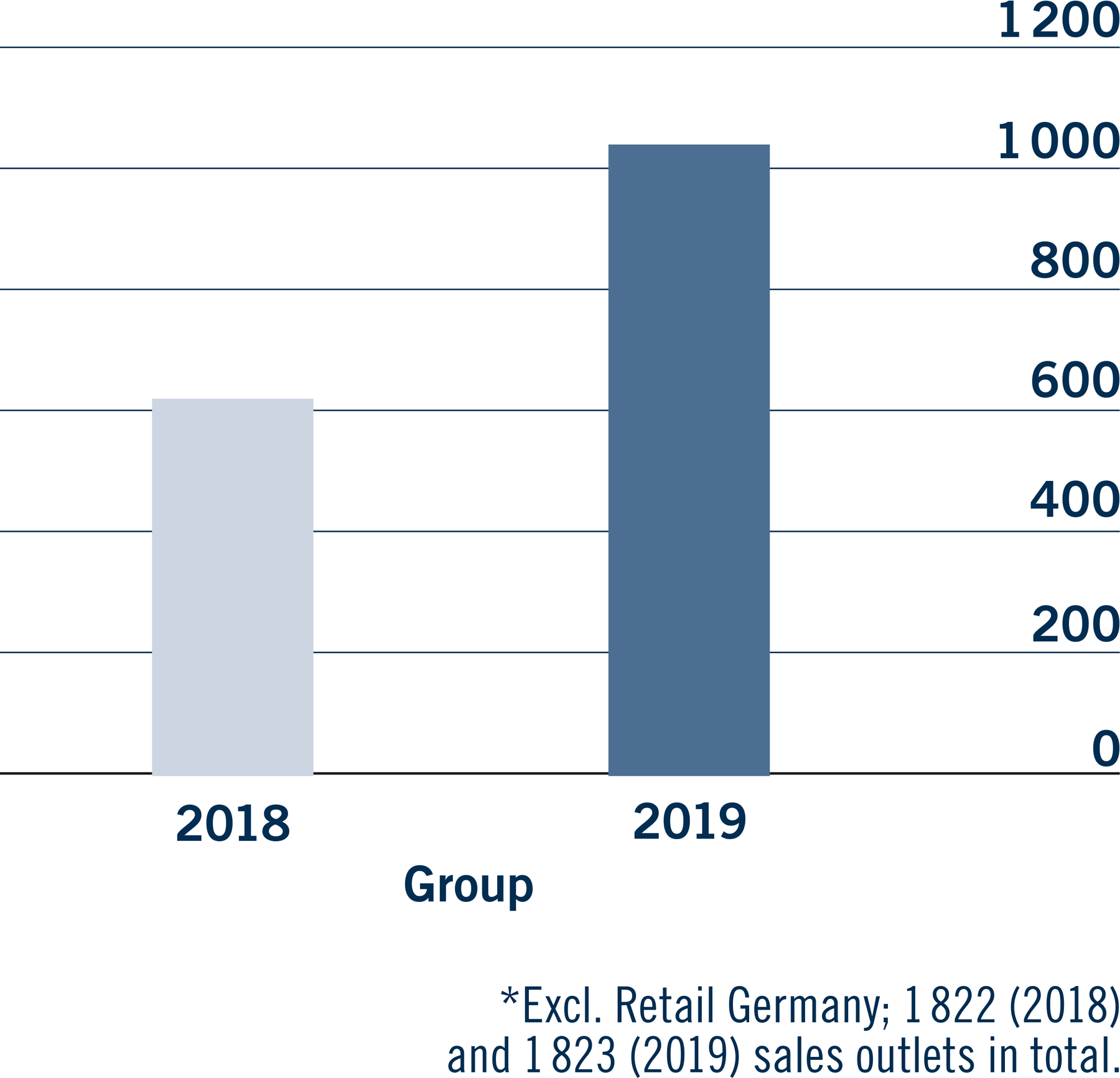

Expansion of the sales outlet network

Valora wants to pursue organic growth, including by expanding its sales outlet network.

The main focus in Retail will be on the convenience formats such as avec and ServiceStore DB, as well as k kiosk and tobacco retailer cigo where Valora also sees growth potential.

The growth driver in Food Service is BackWerk. Growth with this format will move towards new sites especially in the Netherlands and Austria as well as shop-in-shop presence.

Selective expansion is planned for the other formats.

In addition to the expansion of current formats, Valora is open to suitable acquisition opportunities in its core business of foodvenience. That may include expanding to new locations.

Expansion of pretzel production capacity

Through its integrated value chain as a pretzel producer, the Food Service division sees expansion potential in its role as a provider of pretzels to retail partners. Valora wants to further improve its strong market position in B2B business through high product quality, adequate production capacity and a strong sales and marketing team. Its main focus is on the two biggest pretzel markets in the world: Germany and the US. Particularly in the US, penetration of the pretzel market is still relatively low. Valora is aiming for annual growth in its B2B channel of up to + 10 % per year by 2025.

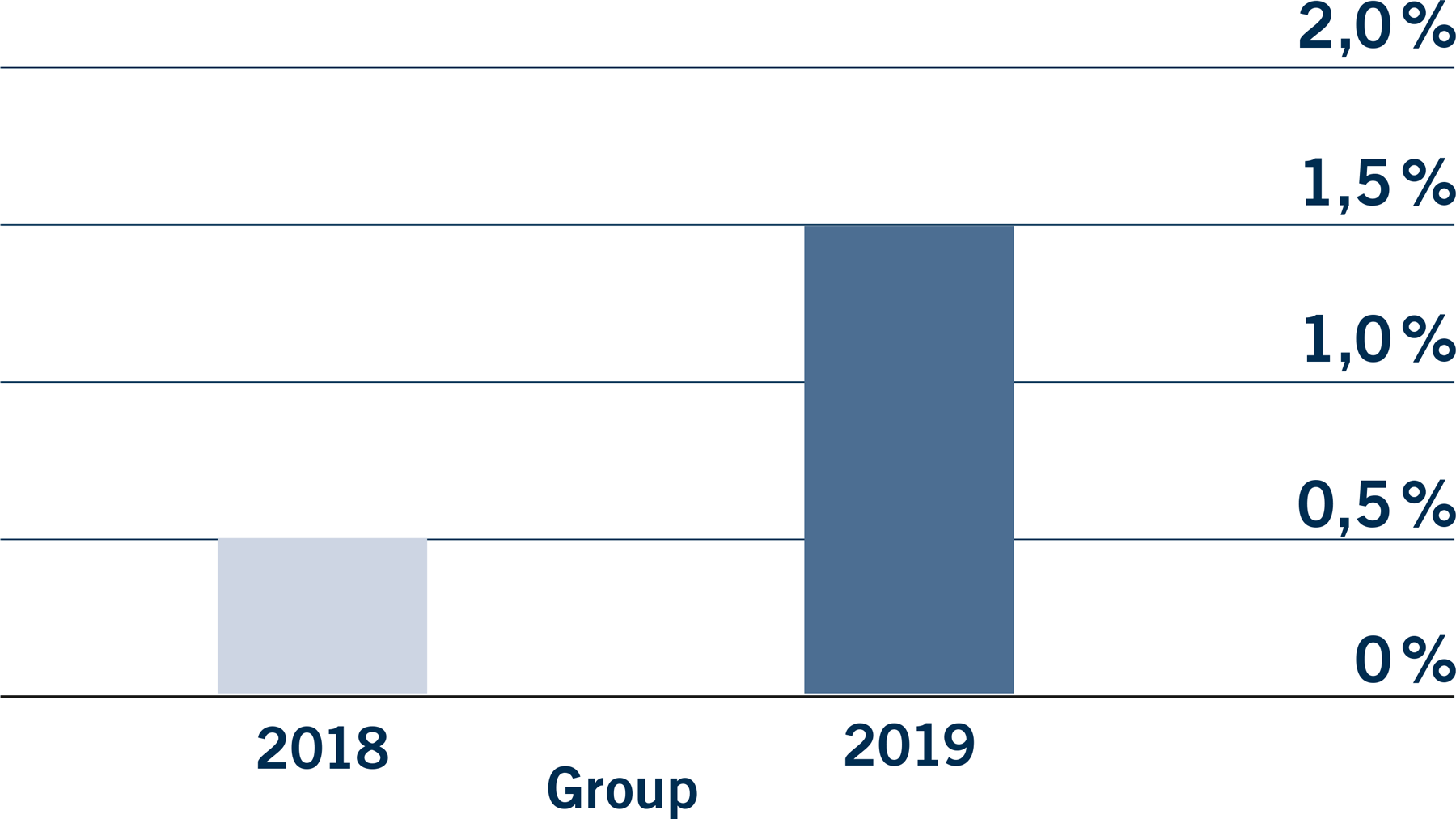

Increasing the offering’s attractiveness

Valora does not plan solely to increase the number of its sales outlets and increase its pretzel production capacity, but is also targeting solid same-store sales growth in the B2C area. The target is annual growth of approximately +0.5 % per year. That is why Valora will focus on optimising the current range, especially the further expansion of the higher-margin food category and the introduction of new fresh products. Tobacco is still a profit contributer, whereby alternative, potentially risk-reduced products offer interesting opportunities through growing demand and higher margins. In addition, Valora’s dense sales outlet network in attractive locations and digitalisation potential place it in a strong position to grow its service offering, for example pick-up and drop-off services or rental models.

Valora’s consumer credit provider bob Finance presents a further growth area and access channel to new B2C and B2B partners, which it will exploit through customer retention measures and new digital financial services.

Stronger position as a promotion platform

Besides growing its proprietary product range, Valora prioritises further consolidation of its position as a preferred marketing platform. Brand partners can strengthen the brand value of their products through direct contact with a broad customer base. Of particular interest in this connection are product promotions in which Valora enjoys significant market share, for example tobacco, press articles or lottery tickets.

Efficiency

Strengthening vertical integration

Valora’s vertical integration is a further key competitive advantage. The internal value added and earnings potential of the Valora Group are enhanced by own brands, such as ok.– or Caffè Spettacolo, and its in-house pretzel production. Own brands are a unique identifier enabling Valora to stand out from the competition and offer an alternative to classical brand products. Valora wants to exploit these strengths even more and to increase the proportion of own brands in its overall product mix. At the same time, Valora aims to establish an even clearer positioning when marketing its own brands.

More efficiency to improve profitability

Valora does not rely solely on growth, profitability is also essential to ensure sustainable financing of investments in expansion and innovation. To that end, Valora works hard to improve efficiency via the following strategic thrusts:

Process improvement through automation, retail analytics, efficient working procedures and increased cooperation within the Group enabling know-how transfer across borders, formats and topics. This also releases additional synergies and improves purchasing conditions. Ultimately cooperation is nurtured through working with pure logistics partners that are distinct from wholesale or, where it makes business sense, optimising own logistics. Logistics for fresh produce will be very important in the future. Delivery frequencies will have to increase in tandem with the growth in food and fresh food supplies. Valora and its partners are specialised in dealing with a large number of delivery locations, small quantities of goods and the inaccessibility of some sales outlets.

Innovation

New food and technology concepts

Valora needs to access new income sources through innovation to remain competitive. Its objective is therefore to launch fresh food and further new concepts and products. Valora will also use new technologies to develop software-based solutions for customers and to develop its operations and organisation. In an initial phase, these solutions will support the current business, increase productivity and speed and enlarge the scope of the business model thereby increasing customer benefit. In a second phase, these solutions should be rolled out to third parties. Valora doesn’t just want to offer customers products but a convenient shopping experience as well. That is contingent on customers contributing to new solution concepts at an early stage so the company can improve its service from their perspective.

Valora is committed to continual renewal as regards its innovatory endeavours. This calls for the courage to try new approaches, plus speed and agility. Valora nurtures innovation through its internal expertise and is developing its in-house skill set for food and technological development. Valora also welcomes innovation from industrial partners and offers them, through its sales outlet network, a platform so it can work with them to pioneer new foodvenience market models.

Performance-oriented culture

More entrepreneurship, customer focus and employer appeal

Valora relies on entrepreneurial operators to implement its strategy. That is why it is Valora‘s ambition that at least 90 % of the sales outlets are managed by franchisees or agents by 2025. An agile organisation is indispensable to ensuring entrepreneurship, customer focus and innovation. Valora will therefore place more emphasis on agility going forward.

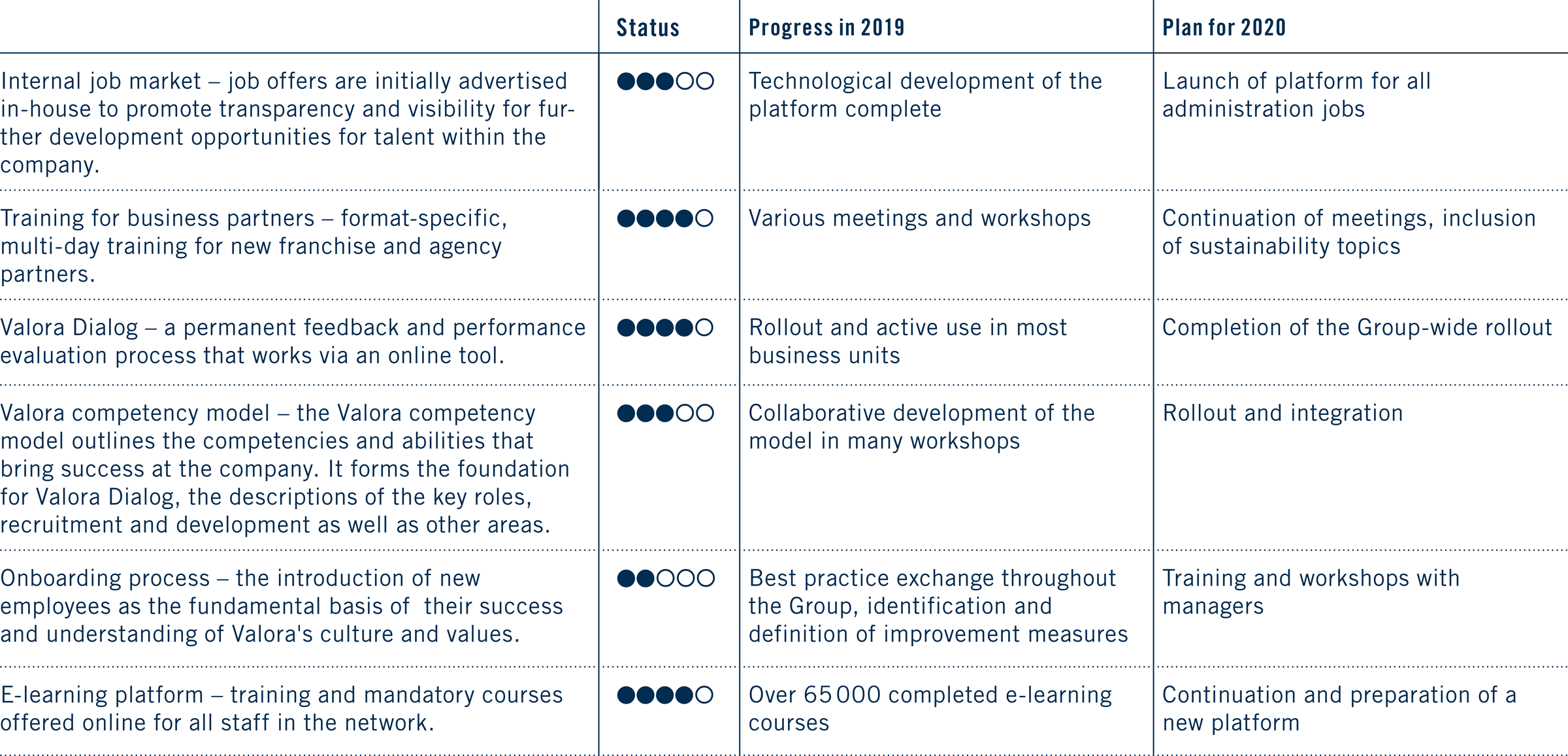

Valora wants to offer its staff an open, dynamic working environment where they can develop through future-oriented competencies, horizontally as well as vertically. The Valora competency model creates clarity regarding what is expected of employees and the contribution they can make to the successful implementation of the corporate strategy. Valora’s objective is to exploit employees’ strengths, nurture talent and enable them to take the initiative and realise ideas. They gain the required knowhow on the job and through targeted training.

Valora wants to strengthen its appeal as an employer so it can attract and retain talented people with strong potential. To that end, Valora recruits employees who fit the corporate culture in addition to having the requisite professional competence.

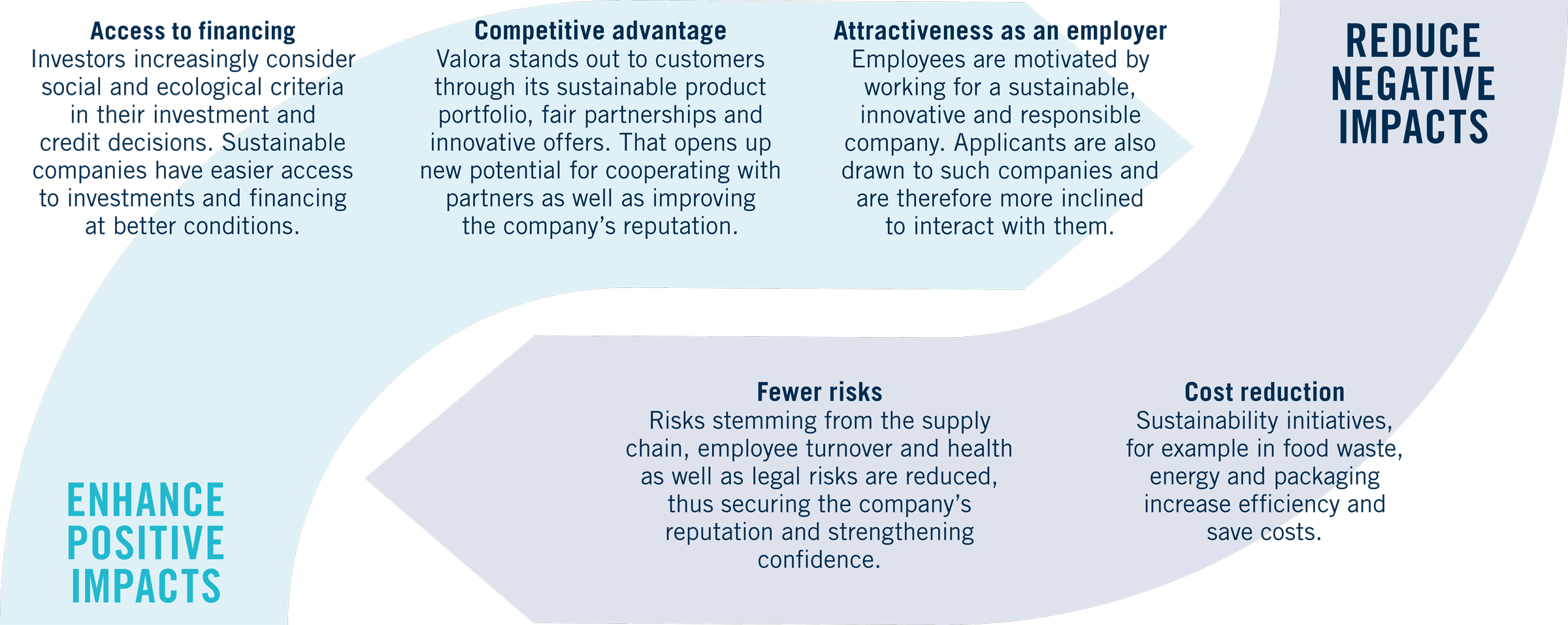

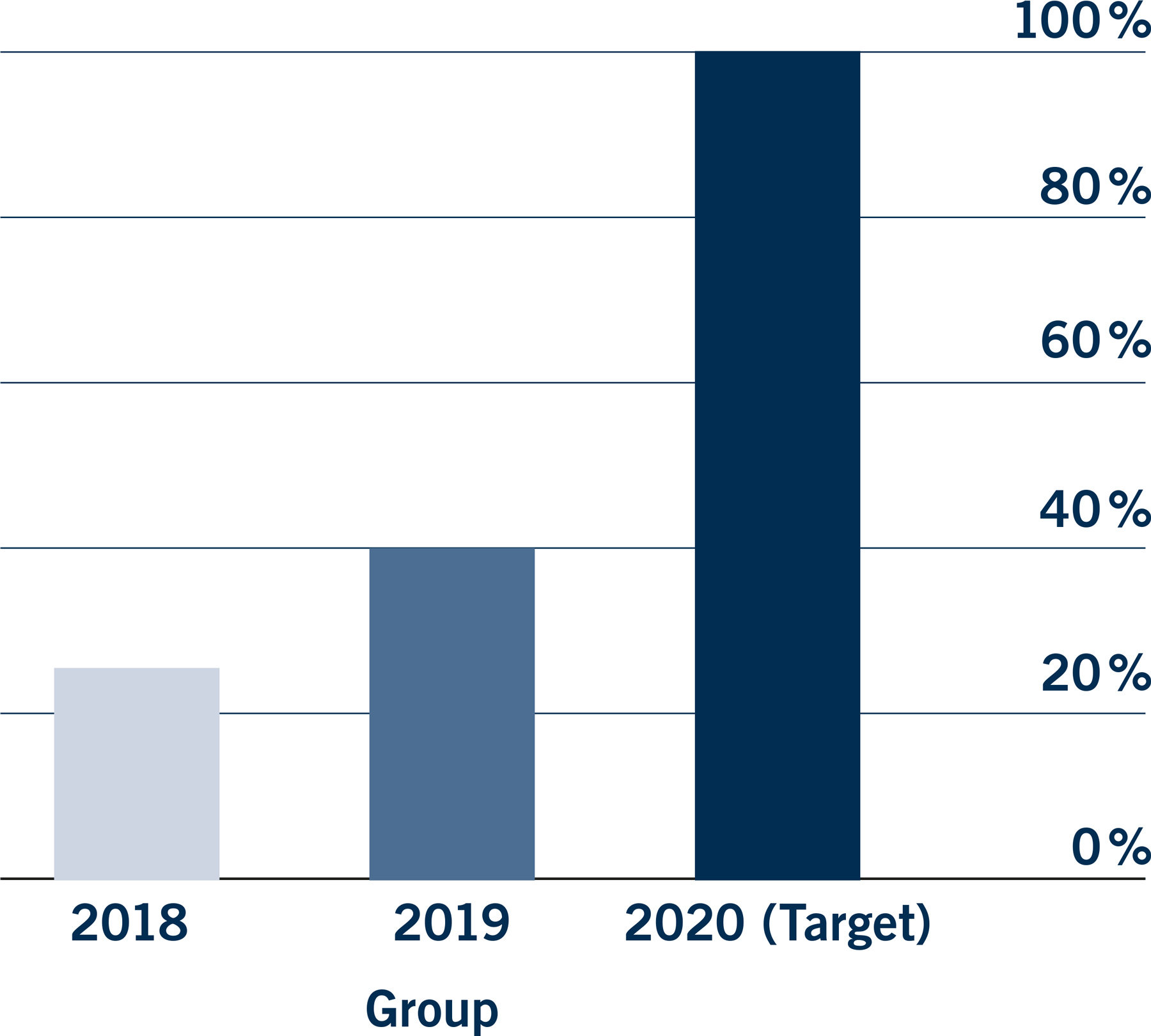

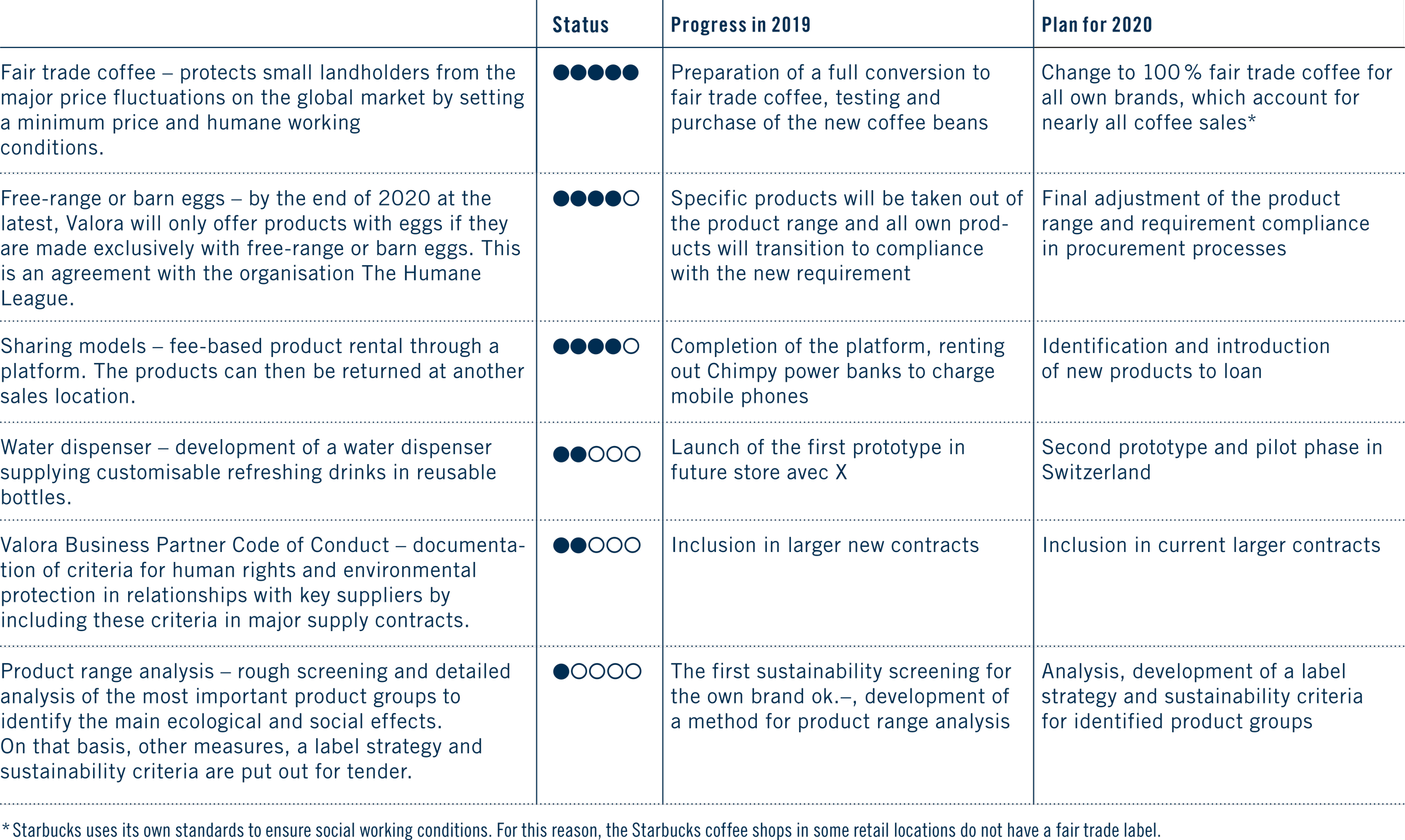

Sustainability

For people and the environment

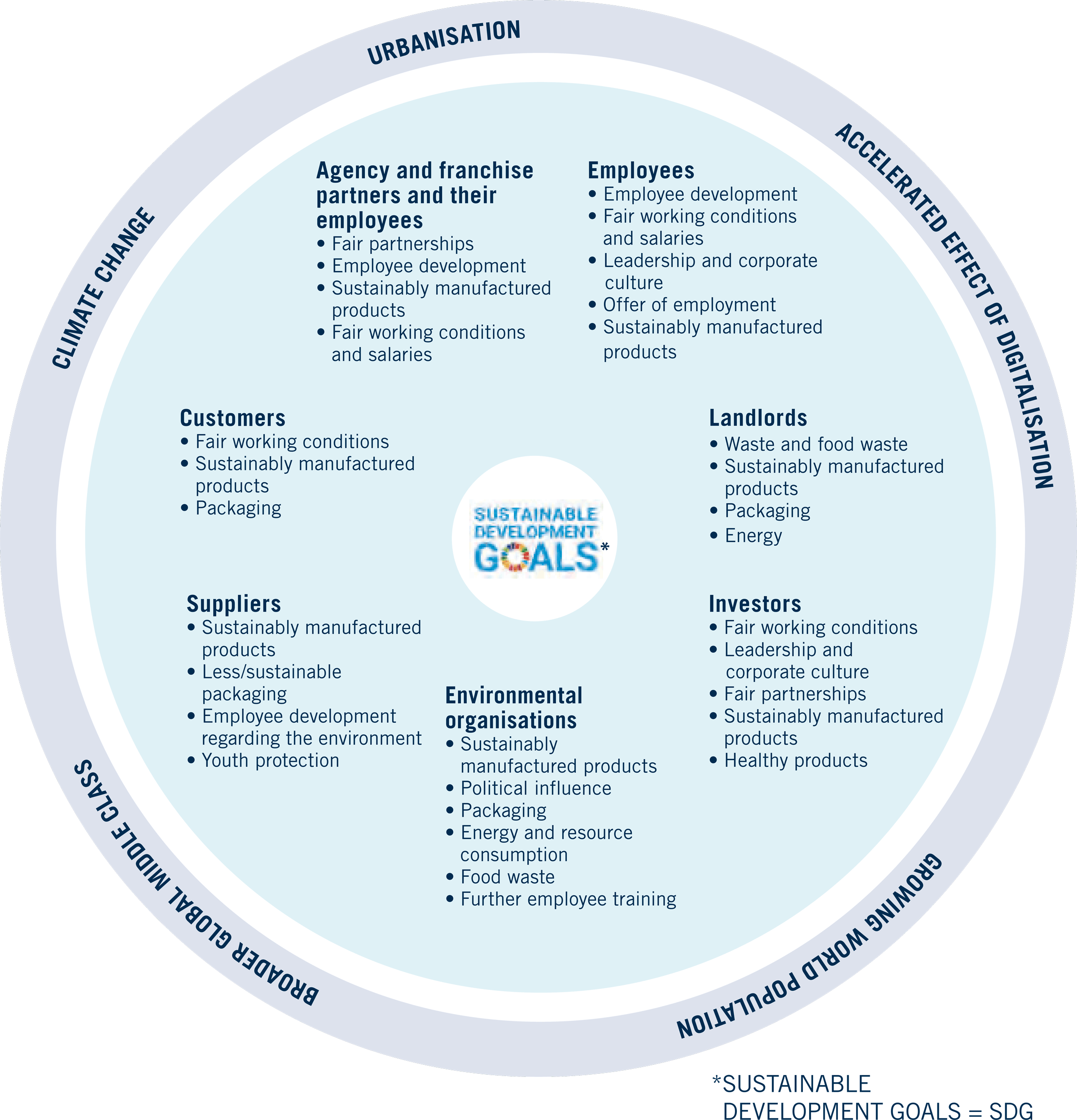

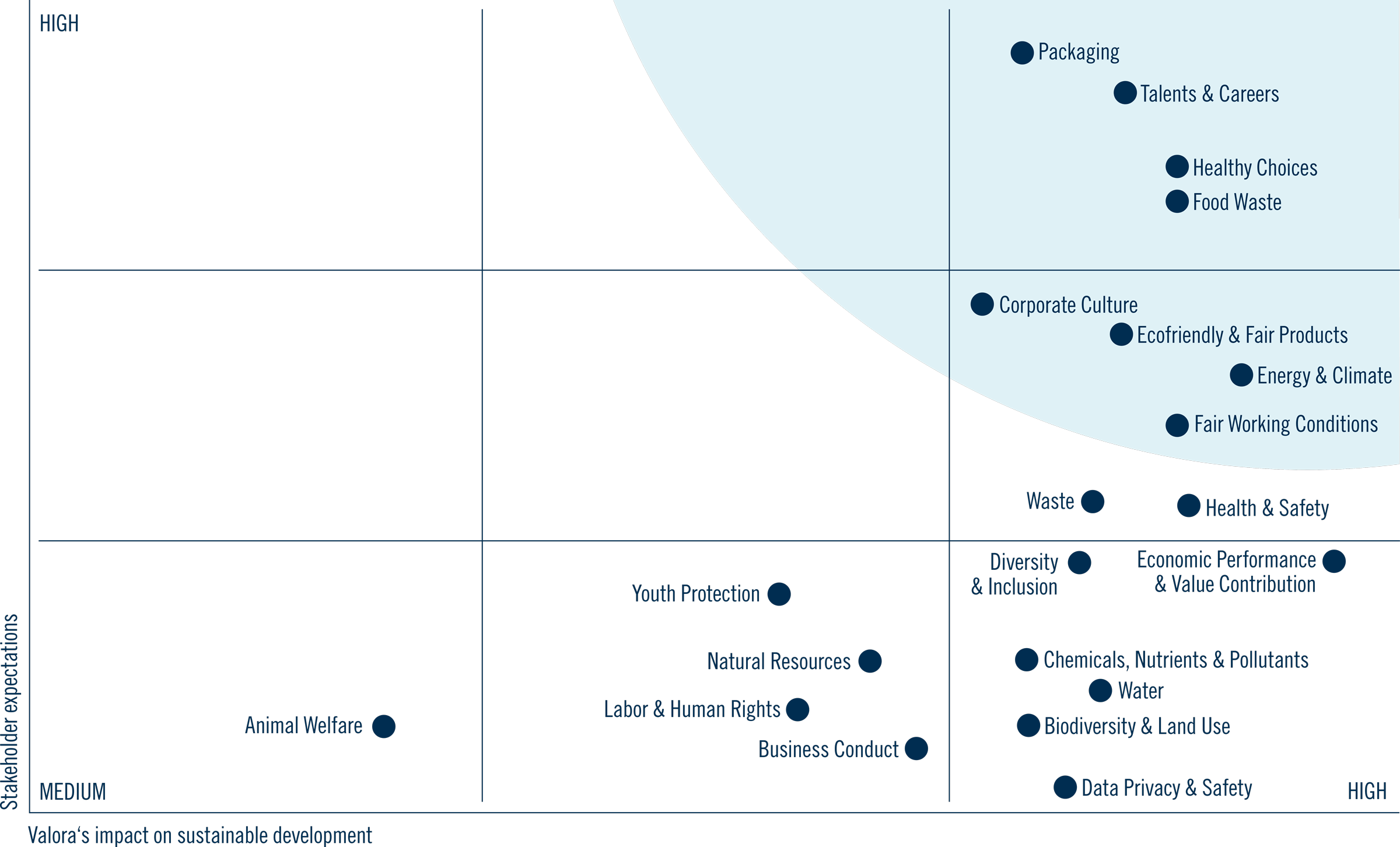

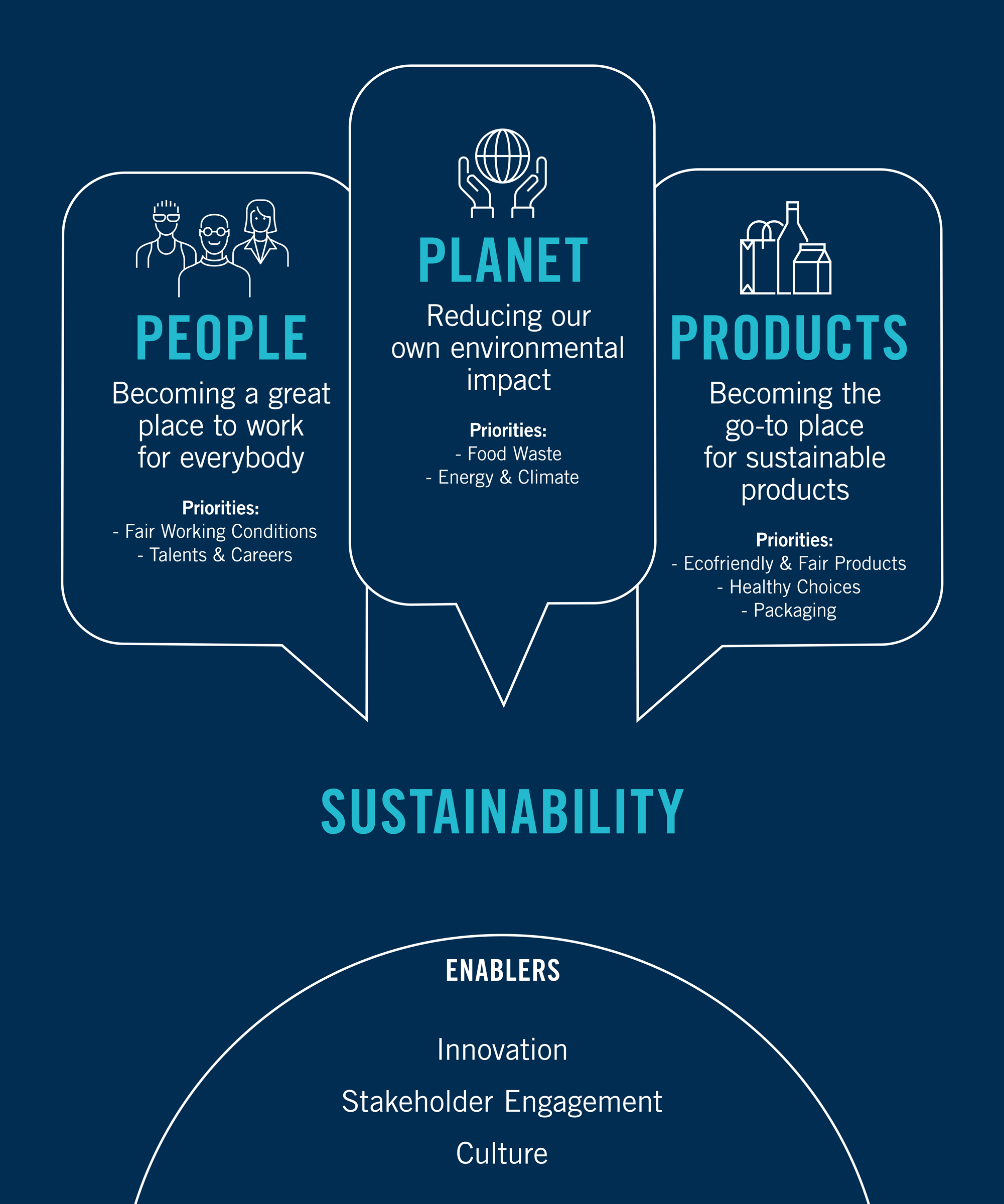

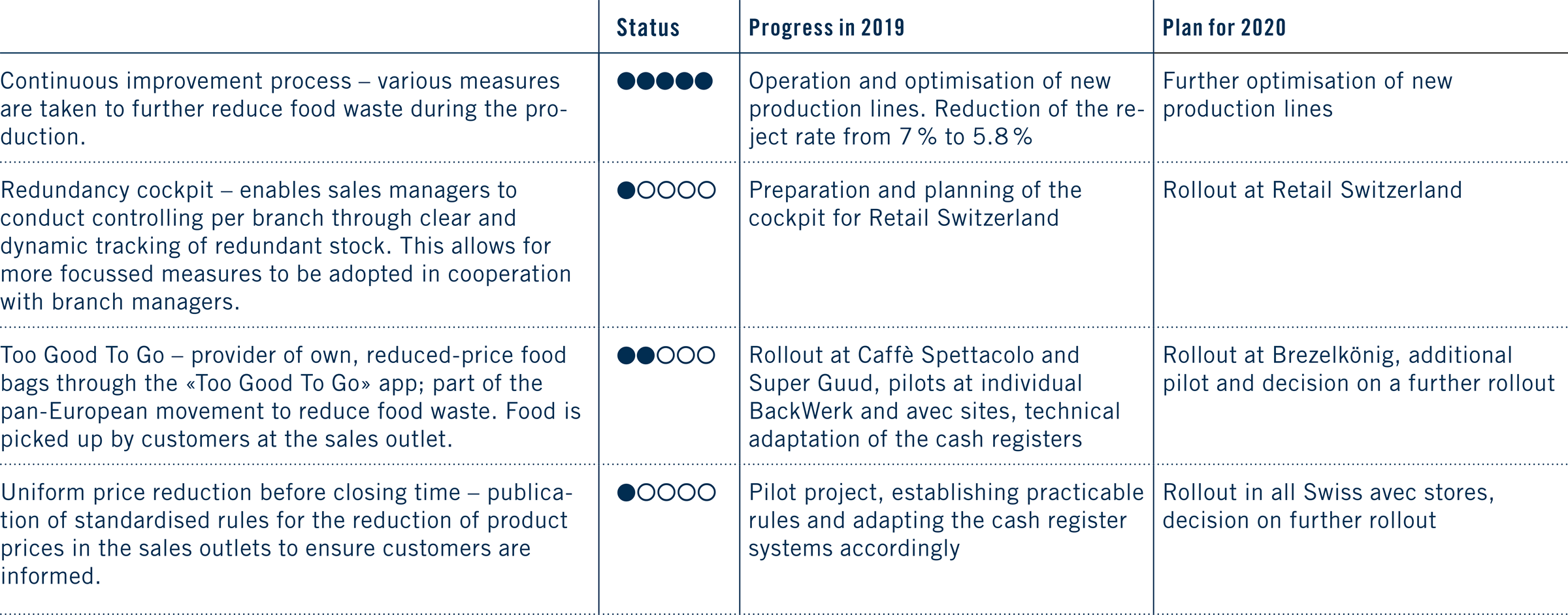

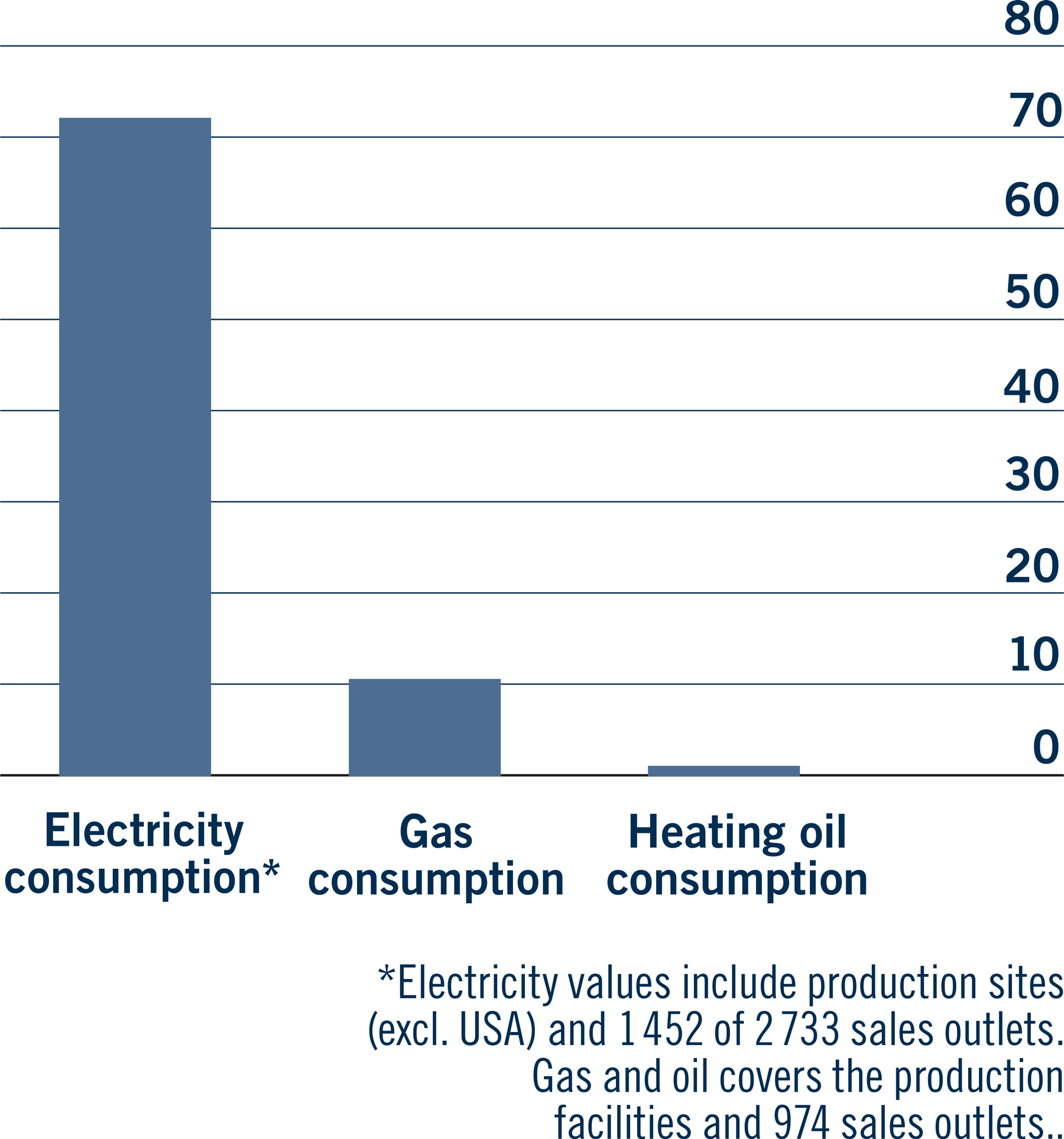

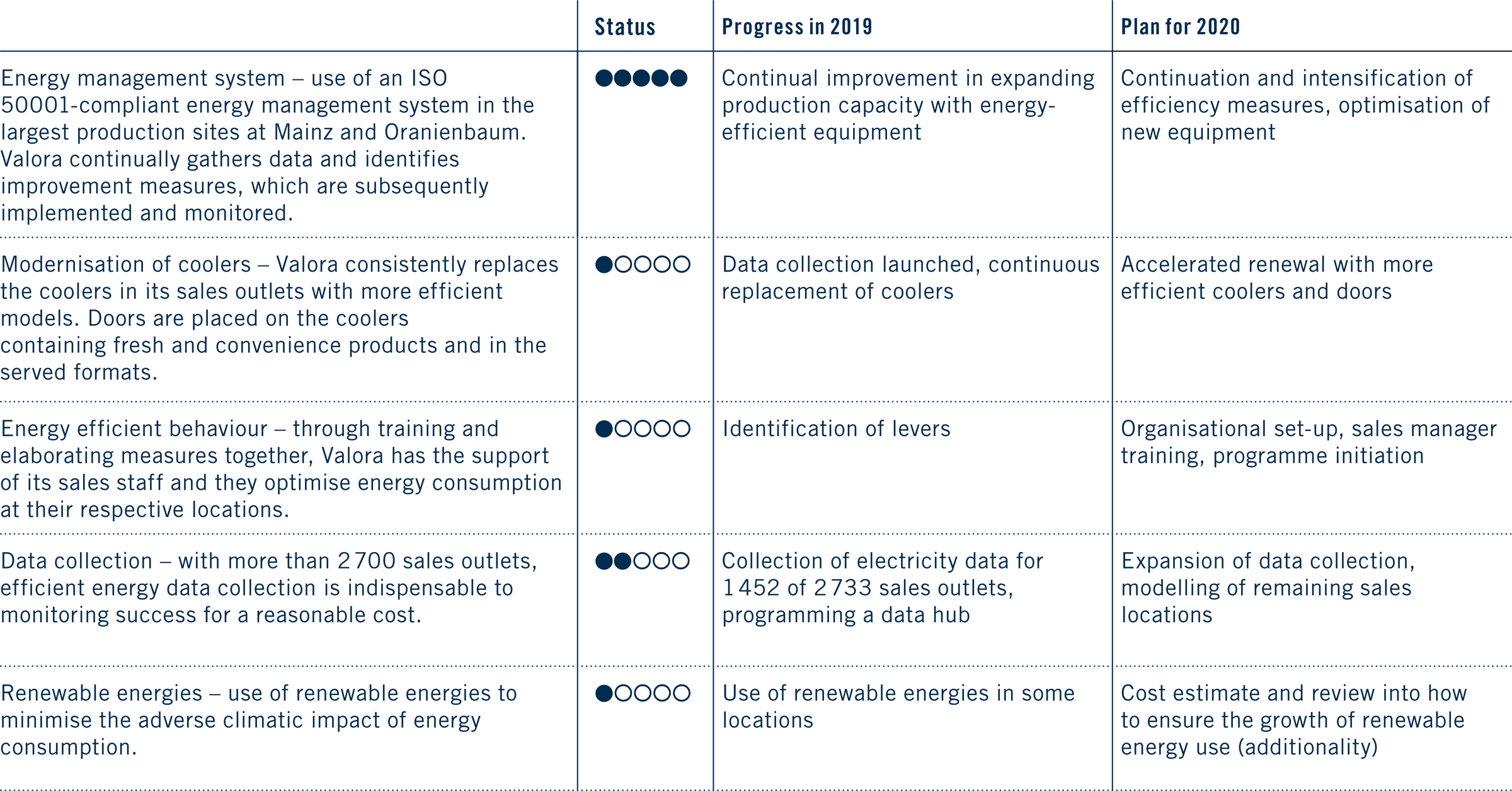

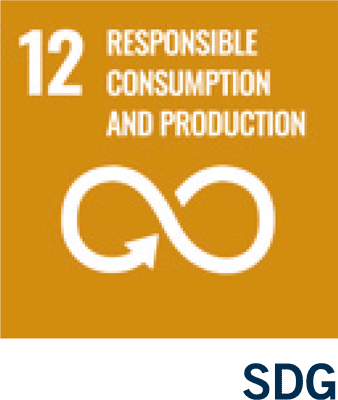

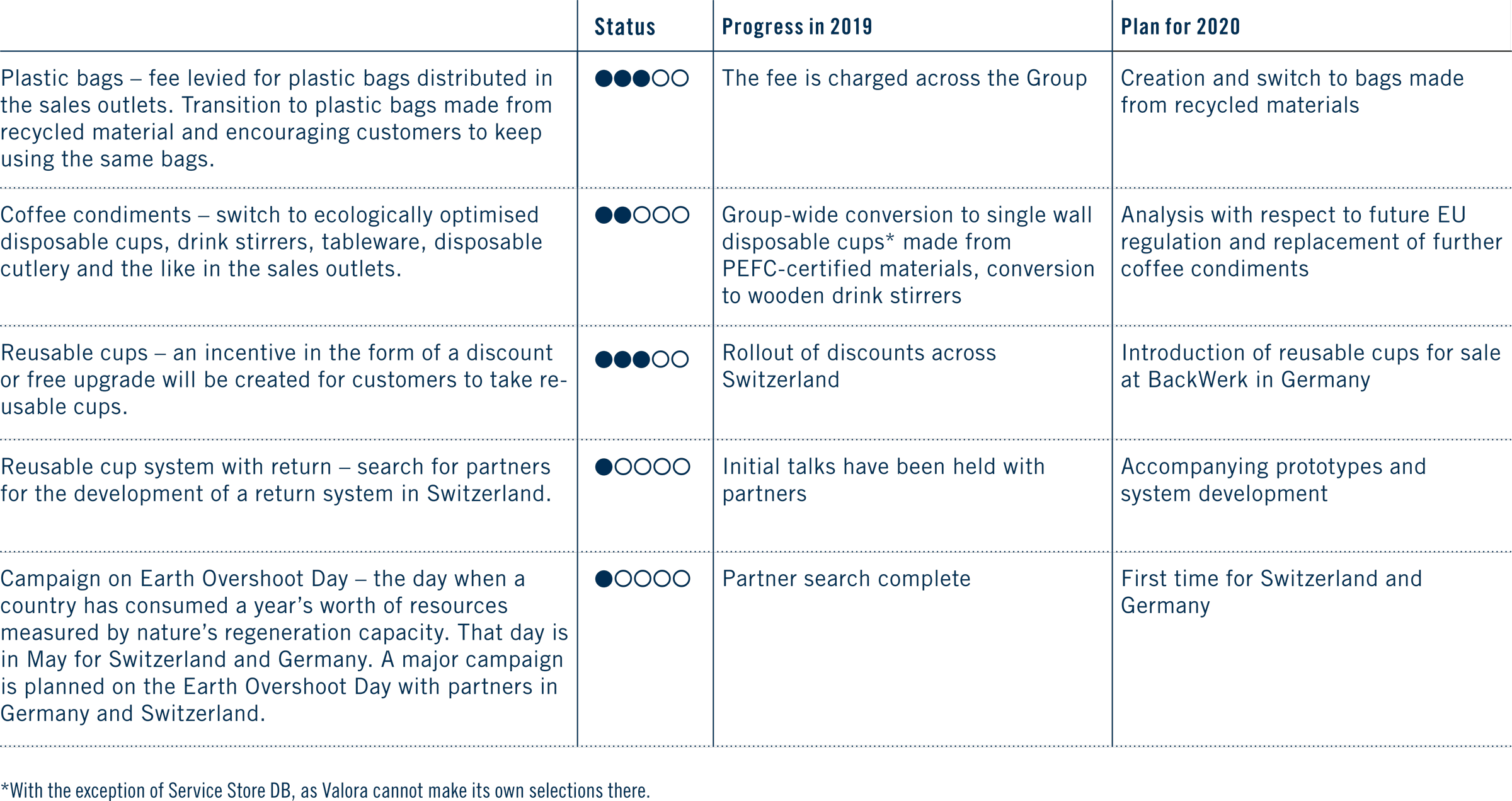

The stakeholders of Valora rightly expect it to contribute to sustainable development as a responsible company. For that reason, Valora’s declared aim is to square profitable growth with sustainable growth by adapting its operational processes, procedures and products to the changing requirements in a targeted manner. Valora pursues a comprehensive approach to sustainability – based on the three action areas of People, Planet and Products – and is careful with its resources. In the process, the priority is fair employment conditions for all employees in the network and the promotion of talent and careers. Valora also aims to reduce its impact on the environment, implementing measures to avoid food waste, cut energy consumption and protect the climate. Finally, Valora aspires to offer environmentally friendly, fair products and healthy alternatives while also paying attention to the issue of sustainable packaging.

Operational financial targets for 2025

Valora has set itself ambitious but realistic operational targets for the period up to 2025:

- External sales:

+2 – 3 % per year - Gross profit margin:

on average +0.5 percentage points per year - EBIT margin:

on average +0.2 percentage points per year - Earnings per share*:

on average +7 % per year

In the medium term, Valora expects the EBIT margin to grow to approximately 5 % in 2022. By then, the conversion of 262 SBB locations, which were successfully secured until 2030 in a tender, will be concluded. This target is in line with the long-term operational targets.

* Without extraordinary effects.